Jurisdictions

- Bermuda

- Guernsey

- Bahamas

- Barbados

- Seychelles

- Liechtenstein

- Singapore

- British Virgin Islands

- Hong Kong

- Luxembourg

- Antigua

- Switzerland

- Cayman Islands

- Nevis

- New Zealand

- Belize

- Netherlands

- Ireland

- United Kingdom

- United Arab Emirates

- Mauritius

- Jersey

- Labuan

- Rwanda

- Gibraltar

- Marshall Islands

- Samoa

- Panama

- St Vincent & The Grenadines

- Austria

- Madeira

Industry Sectors

- Hedge Funds and Alternative Investments

- Citizenship and Residency

- International Tax Planning

- Islamic Finance

- Fintech

- Insurance/Reinsurance

- Investment Funds

- Trusts And Foundations

- Private Banking

- Wealth Management

- Philanthropy

- Offshore Securities Markets

- Sustainable Finance

- Family Offices

- Arbitration

- Regulation and Policy

- Comment

- Big Debate

- In the Chair

- Global Regulation & Policy

- Features

- Sector Research

- Jurisdictions

- British Virgin Islands

- Cayman Islands

- Belize

- Bahamas

- Guernsey

- Switzerland

- Bermuda

- Barbados

- Singapore

- Hong Kong

- Luxembourg

- Labuan

- Jersey

- United Arab Emirates

- Ireland

- New Zealand

- Netherlands

- Liechtenstein

- Mauritius

- Antigua

- Rwanda

- Austria

- Seychelles

- Anguilla

- Samoa

- Marshall Islands

- Gibraltar

- Nevis

- United Kingdom

- North America

- Canada

- Asia

- Africa

- Latin America

- Australasia

- Europe

- Industry Sectors

- Hedge Funds and Alternative Investments

- Citizenship and Residency

- International Tax Planning

- Islamic Finance

- Fintech

- Insurance/Reinsurance

- Investment Funds

- Trusts And Foundations

- Private Banking

- Wealth Management

- Philanthropy

- Offshore Securities Markets

- Sustainable Finance

- Family Offices

- Arbitration

- Regulation and Policy

22/05/23

IFC Review 2023

SUBSCRIBE NOW TO RECEIVE PRINT AND DIGITAL COPIES OF ALL OUR MAGAZINES, INCLUDING THE ECONOMIC REPORT, THE IFC REVIEW AND IFC CARIBBEAN.

Editor's Note:

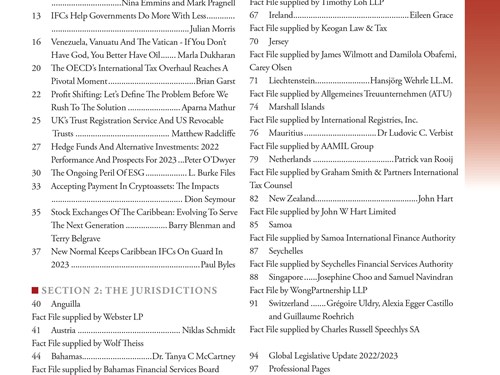

Welcome to the 2023 edition of IFC Review. As always, this flagship publication assembles established practitioners from around the globe to create a state-of-play guide to specialist international finance centres and global wealth structuring.

After a year dominated by the Russia-Ukraine crisis and the resulting international sanctions and trade disruption, November saw a small victory for IFCs in the privacy vs transparency dispute with a landmark ruling by the EU Court of Justice that denounced unfettered access to beneficial ownership information.

The ruling had an immediate domino effect across IFCs, with the Crown Dependencies announcing a delay in plans for public access to company ownership records. The matter will continue to be the subject of debate, however, and Shaun Reardon-John from MKS in the BVI argues that proper verification of beneficial ownership information has more benefits than unverified open registers. His article on page 6 proposes the creation of a legislative framework that allows members of the public to apply for beneficial ownership information if certain criteria are met.

Elsewhere in global regulation & policy, efforts to radically reorganise global corporate taxation continue to dominate the agenda of international standard-setting bodies. As participating IFCs gradually work to implement the two-pillared plan, Brian Garst poses the question: is the bureaucratic hand-wringing from the G20 and OECD finally at an end? Check out his analysis of the current state-of-play from page 20.

Beyond regulation, Section One is jam-packed with technical analysis of developments in vital sectors such as Trusts, Hedge Funds and FinTech. Looking at trends for 2023, ESG continues to gain traction within the international wealth management space. Commentary by practitioners in Ireland (page 67) and Singapore (page 88) highlights how established IFCs are working towards a sustainable future through increasing regulation and ESG-focused discourse amongst practitioners and policymakers. However, ESG compliance does face several challenges in terms of robust and uniform definitions and ratings across the board, as argued by Burke Files on page 30.

As evidenced by our comprehensive jurisdiction analyses, IFCs continue to enhance their specialisms through regulatory reforms and legislative amendments. 2022 saw the enactment of the Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Ordinance 2022 in Hong Kong. Meanwhile, Mauritius launched the new Variable Capital Companies structure under the VCC Act in April 2022 to encourage the domiciliation of investment funds in the jurisdiction.

Elsewhere, the Bahamas is working towards regulating the trading of carbon with the passage of The Carbon Market Initiatives Act and Carbon Credits Trading Act, 2022; and Switzerland is in the midst of introducing a new succession law on the transfer of businesses, following the passage of a new inheritance law earlier this year. Our technical articles are complemented by extensive fact file updates which provide readers with the most up-to-date information on key IFCs.

In addition to an extensive jurisdiction focus, our new ‘Global Legislative Update’ section aims to keep our readers informed of the most recent and upcoming legislation across specialist IFCs – head to page 94 for the full list.

In 2023 and beyond, the international wealth management industry faces a plethora of new opportunities, particularly in the form of financial technology innovation and sustainable asset management. Conversely, perpetual international demands and scrutiny will no doubt continue to test the resilience of the offshore industry. IFC Review 2023 firmly demonstrates that whatever the challenge, international finance centres will continue to intermediate, innovate and integrate within the global economy, showing a unique ability to be nimble in response to evolving circumstances.

Hannah Reilly

Assistant Commissioning Editor