Jurisdictions

Regions

Industry Sectors

Fact File

- General

- Tax

- Tax Information Exchange Agreements

- Share Capital

- Entity

- Directors

- Shareholders

- Accounts

- Legislative Update 2023/24

- Other

Fact File Supplied By

Cayman Finance.

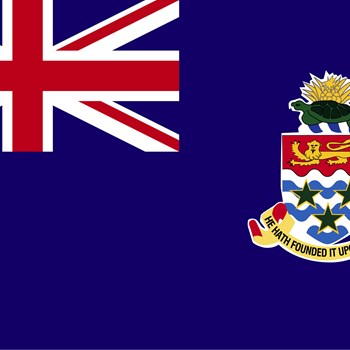

Location

The Cayman Islands are in the western Caribbean, 460 miles south of Miami, Florida and 167 miles northwest of Jamaica.

Time zone

The Cayman Islands observes Eastern Standard Time (-5 UTC) all year. There are no Daylight Saving Time clock changes. As a result, the Islands effectively share Central Daylight Time from the second Sunday in March to the first Sunday in November.

Population

83,671.

Capital

George Town, Grand Cayman.

Airport(s)

Owen Roberts International Airport (Grand Cayman), Charles Kirkconnell International Airport (Cayman Brac), Edward Bodden Airfield (Little Cayman).

Language

English.

Currency

Cayman Islands dollar (CI$) pegged to the US dollar at a rate of CI$1.00 = US$1.20.

Political System

Parliamentary democracy with judicial, executive and legislative branches.

International dialing code

+1 345.

Legal system

Common law and statute with the highest appellate court being the UK Privy Council.

Centre's expertise

Investment funds and asset management, banking, insurance, reinsurance, capital markets, and trusts.

Personal income tax

None.

Corporate income tax

None.

Exchange restrictions

None.

Jurisdictions

Argentina, Aruba, Australia, Belgium, Brazil, Canada, China, Curacao, Czech Republic, Denmark, Faroes, Finland, France, Germany, Greenland, Guernsey, Iceland, India, Ireland, Isle of Man, Italy, Japan, Malta, Mexico, Netherlands, New Zealand, Norway, Poland, Portugal, Qatar, Seychelles, Sint Maarten, South Africa, Sweden, United Kingdom and United States of America.

Permitted currencies

No restrictions.

Minimum authorised capital

No restrictions.

Minimum share issue

Cayman Islands exempted companies must always have at least one share in issue (except for a foundation company which may cease to have shares and members).

Timescale for new entities

Same day incorporation with certificate of incorporation available within 24 hours for an express incorporation.

Incorporation fees

Fees start at approximately US$853.66 for an Exempted Company.

Annual fees

Fees start at approximately US$1006.10 per annum.

Minimum number

One. Two if regulated by the Cayman Islands Monetary Authority.

Residency requirements

None.

Corporate directors

Allowed.

Meetings/frequency

No statutory requirement. This is up to the board to decide. If regulated as a mutual fund by the Cayman Islands Monetary Authority, meetings should be held at least twice a year in person, or via a telephone or video conference call.

Disclosure

No public disclosure for exempted companies. However, a private register of beneficial ownership is maintained by the government.

Bearer shares

Not permitted.

Minimum number

One share issued to the subscriber on incorporation by operation of law. A Cayman Islands exempted must always have at least one member except for a Foundation company.

Public share registry

None for exempted companies.

Meetings/frequency

None.

Annual return

None.

Audit requirements

None unless regulated by the Cayman Islands Monetary Authority.

Recent Legislation

- Anti-Corruption Act (2024 Revision)

- Anti-Money Laundering Regulations (2023 Revision)

- Beneficial Ownership (Limited Liability Companies) Regulations (2023 Revision)

- Companies Act (2023 Revision)

- Companies (Amendment of Schedule 5) Order, 2023

- Companies (Amendment of Schedule 4) Order, 2023

- Companies Management Act (2024 Revision)

- Directors Registration and Licensing (Amendment) Act 2023

- Exempted Limited Partnership (Amendment) Regulations, 2023

- Identification Register Act 2023

- International Tax Co-operation (Economic Substance) Act (2024 Revision)

- International Tax Co-operation (Economic Substance) (Prescribed Dates) Regulations (2024 Revision)

- Limited Liability Companies Act (2023 Revision)

- Limited Liability Companies (Fees) (Amendment) Regulations, 2023

- Limited Liability Partnership Act (2023 Revision)

- Limited Liability Partnership (Fees) (Amendment) Regulations, 2023

- Monetary Authority (Amendment) Act 2023

- Money Services Act (2024 Revision)

- Partnership Act (2024 Revision)

- Proceeds of Crime Act (2024 Revision)

- Securities Investment Business (Amendment) Act 2023

- Special Economic Zones Act (2023 Revision)

- Virtual Asset (Service Providers) Act (2024 Revision)

Associated Guidance

• Cayman Islands Compliance Association Industry Update: Automatic Exchange of Information

• CIMA Industry Notice – Virtual Asset Service Provider 2023 Annual Renewal Fees

• CIMA List of Approved Stock Exchanges

• CIMA Regulatory Policy: Approved Stock Exchanges

• CIMA Regulatory Policy: Complaints Against Licencees, Registrants and Other Supervised Entities

• CIMA Rule: Corporate Governance for Regulated Entities

• CIMA Rule: Cybersecurity for Regulated Entities

• CIMA Rule and Guidance on Internal Controls for Regulated Entities

• CIMA Statement of Guidance – Corporate Governance for Mutual Funds and Private Funds

• CIMA Statement of Guidance on Nature, Accessibility and Retention of Records

• CIMA Statement of Guidance – Outsourcing Regulated Entities

• CIMA Statement of Guidance – Cybersecurity for Regulated Entities

• CIMA Supervisory Circular: Dividend Payments and Distributions

• CIMA Update to Cayman Financial Sanctions Regime – General Industry Notice

• CIMA Guidance Notes on the Prevention and Detection of Money Laundering, Terrorist Financing and Proliferation Financing in the Cayman Islands, February 2024

• CIMA Regulatory Policy – Consolidated Supervision, November 2023

• Competent Authority for Beneficial Ownership Guidance Notes

• Economic Substance Enforcement Guidelines, Version 1.4

• Financial Reporting Authority – Financial Sanctions Guidance: General Guidance for Financial Sanctions under the Sanctions and Anti-Money Laundering Act 2018 (SAMLA) (January 2024)

Pending Legislation

• Beneficial Ownership Transparency Act, 2023 (Not in force)

• Cayman Islands Identification Card Act, 2022 (not in force)

• Companies (Amendment) Act, 2023 (Not in force)

• Companies (Amendment) Act, 2024 (Not in force)

• Banks and Trust Companies (Amendment) Act, 2023 (Not in force)

• Foundation Companies (Amendment) Act, 2023 (Not in force)

• Insurance (Amendment) No 2) Act, 2023 (Not in force)

• Limited Liability Companies (Amendment) Act, 2023 (Not in force)

• Limited Liability Partnership (Amendment) Act, 2024 (Not in force)

• Local Companies (Control) (Amendment) Bill, 2023

• Mutual Funds (Amendment) Act, 2023 (Not in force)

• Virtual Asset (Service Providers) (Amendment)(No. 2) Act, 2023 (Not in force)

Registered office

Must be located in the Cayman Islands.

Domicile issues

Transfer of domicile is permissible.

Company naming restrictions

Yes - no two companies may have the same name and certain other restrictions as specified in the Companies Law (as amended).