Jurisdictions

- Bermuda

- Guernsey

- Bahamas

- Barbados

- Seychelles

- Liechtenstein

- Singapore

- British Virgin Islands

- Hong Kong

- Luxembourg

- Antigua

- Switzerland

- Cayman Islands

- Nevis

- New Zealand

- Belize

- Netherlands

- Ireland

- United Kingdom

- United Arab Emirates

- Mauritius

- Jersey

- Labuan

- Rwanda

- Gibraltar

- Marshall Islands

- Samoa

- Panama

- St Vincent & The Grenadines

- Austria

- Madeira

Industry Sectors

- Hedge Funds and Alternative Investments

- Citizenship and Residency

- International Tax Planning

- Islamic Finance

- Fintech

- Insurance/Reinsurance

- Investment Funds

- Trusts And Foundations

- Private Banking

- Wealth Management

- Philanthropy

- Offshore Securities Markets

- Sustainable Finance

- Family Offices

- Arbitration

- Regulation and Policy

- Comment

- Big Debate

- In the Chair

- Global Regulation & Policy

- Features

- Sector Research

- Jurisdictions

- British Virgin Islands

- Cayman Islands

- Belize

- Bahamas

- Guernsey

- Switzerland

- Bermuda

- Barbados

- Singapore

- Hong Kong

- Luxembourg

- Labuan

- Jersey

- United Arab Emirates

- Ireland

- New Zealand

- Netherlands

- Liechtenstein

- Mauritius

- Antigua

- Rwanda

- Austria

- Seychelles

- Anguilla

- Samoa

- Marshall Islands

- Gibraltar

- Nevis

- United Kingdom

- North America

- Canada

- Asia

- Africa

- Latin America

- Australasia

- Europe

- Industry Sectors

- Hedge Funds and Alternative Investments

- Citizenship and Residency

- International Tax Planning

- Islamic Finance

- Fintech

- Insurance/Reinsurance

- Investment Funds

- Trusts And Foundations

- Private Banking

- Wealth Management

- Philanthropy

- Offshore Securities Markets

- Sustainable Finance

- Family Offices

- Arbitration

- Regulation and Policy

01/11/18

IFC Caribbean 2018

Subscribe now to receive print and digital copies of all our magazines, including the Economic Report, the IFC Review and IFC Caribbean.

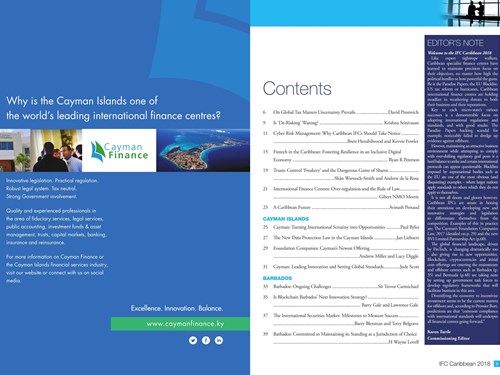

Editor's Note:

Like expert tightrope walkers, Caribbean specialist finance centres have learned to maintain precision focus on their objectives, no matter how high the political hurdles or how powerful the gusts. Be it the Paradise Papers, the EU Blacklist, US tax reform or hurricanes, Caribbean international finance centres are holding steadfast in weathering threats to both their business and their reputations.

Key to each micro-state's various successes is a demonstrable focus on adopting international regulations and standards, and with good results. The Paradise Papers hacking scandal for example, noticeably failed to dredge up evidence against offshore.

However, maintaining an attractive business environment while attempting to comply with ever-shifting regulatory goal posts is a hard balance to strike and certain international protocols can appear questionable. Blacklists imposed by supranational bodies such as the EU are one of the most obvious (and disquieting) examples - where larger nations apply standards to other which they do not apply to themselves.

It is not all doom and gloom however. Caribbean IFCs are astute in honing their attentions on developing new and innovative strategies and legislation to differentiate themselves from the competition. Examples of this in practice are; The Cayman's Foundation Companies Law, 2017 (detailed on p.29) and the new BVI Limited Partnership Act (p.60).

The global financial landscape, driven by FinTech, is changing dramatically too - also giving rise to new opportunities. Blockchain, cryptocurrencies and initial coin offerings are entering the mainstream and offshore centres such as Barbados (p.35) and Bermuda (p.48) are taking note by setting up government task forces to develop regulatory frameworks that will facilitate business in this area.

Diversifying the economy to incentivise investment seems to be the current mantra for offshore and, according to Premier Burt, predictions are that "common compliance with international standards will underpin all financial centres going forward."

Karen Turtle

Commissioning Editor