Jurisdictions

Regions

Industry Sectors

Fact File

Fact File Supplied By:

BVI Finance Limited.

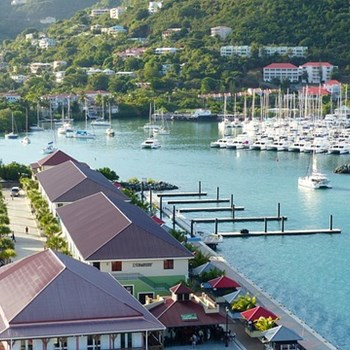

Location

Eastern Caribbean.

Time Zone

Greenwich Mean Time -4.

Population

32,800 (2017).

Capital

Road Town.

Airport(s)

Terrance B. Lettsome International Airport.

Language

English.

Currency

US Dollar.

Political System

Democratic 13-member legislature/government.

International Dialing Code

+1 284.

Legal System

Based on English common law. UK Privy Council is final court of appeal.

Centre's expertise

Renowned as a corporate domicile for business companies, trust settlements, captive insurance, mutual funds and shipping registration.

Personal income tax

0%.

Corporate income tax

No income (profit) tax. Payroll tax-resident companies: 10% or 14% (employees: 8% fixed, employers: 2% or 6% depending on business size). Non-resident companies: same as resident, on BVI-based employees only.

Exchange restrictions

None.

Tax Information Exchange Agreements

Aruba, Australia, Canada, China, Curacao, Czech Republic, Denmark, Faroe Islands, Finland, Germany, Greenland, Guernsey, Iceland, India, Ireland, Isle of Man, Japan, Netherlands, New Zealand, Norway, Poland, Portugal, Sint Maarten, South Korea, Sweden, United Kingdom and United States.

Double Taxation Agreements

Isle of Man, Guernsey, Poland, South Korea, Japan, Canada, Netherlands, Czech Republic, Sweden and India.

Permitted currencies

All currencies permitted.

Minimum authorised capital

None unless engaged in regulated activities which are subject to varying requirements based on licence type.

Minimum share issue

One share.

Shelf companies

BVI business companies, limited partnerships, segregated portfolio companies, restricted purpose companies, companies limited by shares and/or guarantee.

Timescale for new entities

24 hours (BVI business companies, LPs).

Incorporation fees

Business companies $350-$5,000 depending on the company type, whether it is authorised to issue shares, its share structure (number and type of shares authorised for issue); Limited Partnership ($500).

Annual fees

Business companies, US$350-US$1,000 depending on share capital structure (number and type of share authorised for issue); limited partnership US$500.

Minimum number

One.

Residency requirements

At least one director must be resident where the company is licensed to perform certain banking, trust, fiduciary and insurance business.

Corporate directors

Permitted.

Meetings/ frequency

As directors determine.

Disclosure

Shareholder details must be maintained with company registered agent.

Bearer shares

Permitted (must be held by an authorised custodian or a recognised custodian).

Minimum number

One.

Public share registry

No.

Meetings/ frequency

As directors or shareholders determine.

Annual return

No.

Audit requirements

Annual audited statements are required for entities licensed to carry out regulated business.

Registered office

Yes, must be in the BVI and must be the office of the registered agent.

Domicile issues

Re-domiciliation to and from the BVI allowed under BVI law.

Company naming restrictions

Restricted words such as 'banking', 'insurance', 'fund', 'trustee' will not be allowed without relevant licence.